HSN Code for PCB Assembly: What You Need to Know

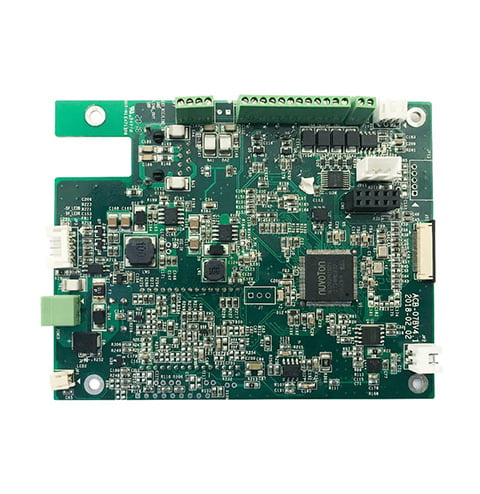

If you’re involved in the PCB assembly process, you’ve probably heard of the term HSN code. HSN stands for Harmonized System of Nomenclature, and it is an internationally recognized system that is used to classify goods for taxation and trade purposes. The HSN code for PCB assembly is an important code that helps classify the product for customs clearance and duty savings.

The HSN code for PCB assembly is a unique code that is used to identify the product and its classification. This code is used by customs officials to determine the duty and taxes that need to be paid when importing or exporting PCB assemblies. It is important to correctly classify the product using the HSN code to avoid any delays or penalties during the customs clearance process. If you’re involved in the PCB assembly business, it is essential to understand the HSN code and its importance.

Overview of HSN Codes

If you are involved in the import or export of PCB assemblies, you may have come across the term “HSN code.” HSN stands for Harmonized System of Nomenclature, which is a standardized system used to classify goods for international trade. In this section, we will provide an overview of HSN codes, their structure, and their importance in the context of PCB assembly.

HSN Code Structure

HSN codes consist of six digits, with additional digits added for more detailed classification. The first two digits represent the chapter under which the goods fall, the next two digits represent the heading, and the final two digits represent the subheading. For example, the HSN code for PCB assembly is 8534.00.00, where 85 represents the chapter for electrical machinery and equipment, 34 represents the heading for “electrical machinery and equipment and parts thereof,” and 00.00 represents the subheading for “Printed circuit assemblies (including those for surface mounting) and the printed circuits mounted with electronic components.”

Importance of HSN Codes

HSN codes are important for several reasons. Firstly, they are used by customs officials to determine the appropriate duties and taxes to be levied on imported or exported goods. Secondly, they are used by businesses to accurately classify their products for trade purposes. Finally, they are used by governments to collect trade statistics and monitor international trade patterns.

In the context of PCB assembly, HSN codes are particularly important because they help to identify the type of PCB assembly and its components. For example, the HSN code for a 4-layer assembled rigid PCB would be 8517.70.41, where 85 represents the chapter for electrical machinery and equipment, 17 represents the heading for “vehicles, aircraft, vessels and associated transport equipment,” 70 represents the subheading for “other parts and accessories of vehicles,” and 41 represents the sub-subheading for “other parts and accessories of vehicles of headings 87.11 to 87.13.” This level of detail is important because it allows customs officials to accurately assess the duties and taxes to be levied on the product.

In summary, HSN codes are a standardized system used to classify goods for international trade. They consist of six digits and are used by customs officials, businesses, and governments to accurately classify products for trade purposes and collect trade statistics. In the context of PCB assembly, HSN codes are particularly important because they help to identify the type of PCB assembly and its components.

HSN Code for PCB Assembly

If you are importing or exporting PCB assembly, it is important to know the correct Harmonized System of Nomenclature (HSN) code. The HSN code is a standardized system of names and numbers used to classify goods in international trade. In this section, we will discuss how to identify the correct HSN code for PCB assembly and the tax implications of using the wrong code.

Identifying Correct HSN Code

The HSN code for PCB assembly depends on the type of product being imported or exported. For example, a populated, loaded, or stuffed printed circuit board has a different HSN code than a bare printed circuit board. It is important to identify the correct code to avoid delays in customs clearance and potential penalties.

To identify the correct HSN code, you can refer to the Indian Customs Tariff (ICT) or consult with a customs broker. The ICT provides a list of HSN codes for different types of goods, including PCB assembly. Alternatively, you can use online resources such as Seair or PCB JHY to search for the correct HSN code.

Tax Implications

Using the correct HSN code is important for tax purposes. The HSN code determines the rate of customs duty, goods and services tax (GST), and other taxes and fees that may apply to your shipment. If you use the wrong code, you may be subject to additional taxes, penalties, and even seizure of your goods.

For example, if you import a populated, loaded, or stuffed printed circuit board and use the wrong HSN code, you may be subject to a higher rate of customs duty and GST than if you had used the correct code. This can significantly increase the cost of your shipment and impact your bottom line.

It is important to identify the correct HSN code for PCB assembly to avoid delays in customs clearance and potential penalties. By using the correct code, you can ensure that you are paying the correct amount of taxes and fees and avoid any surprises at the border.

Classification Challenges

When it comes to classifying PCB assembly under the Harmonized System of Nomenclature (HSN), there can be some challenges. In this section, we will discuss some common misclassifications and how to resolve classification issues.

Common Misclassifications

One of the most common misclassifications for PCB assembly is under the wrong heading. For example, some may classify it under heading 84, which covers nuclear reactors, boilers, and machinery. However, PCB assembly should be classified under heading 85, which covers electrical machinery and equipment.

Another common misclassification is confusing PCB assembly with bare PCBs. Bare PCBs have a different HS code (8534.00), while PCB assembly has its own HS code (8542.31). It is important to distinguish between the two to ensure accurate classification and avoid any potential legal or financial issues.

Resolving Classification Issues

If you are unsure about how to classify your PCB assembly, there are a few steps you can take to resolve classification issues. First, review the HSN classification guidelines and consult with a customs broker or trade expert if necessary. They can provide guidance on how to classify your PCB assembly correctly.

You can also request a binding ruling from the customs authority in your country. This ruling provides a legally binding decision on the classification of your PCB assembly, which can help avoid any potential disputes or penalties.

In summary, accurate classification of PCB assembly under the HSN is crucial for foreign trade projects. By avoiding common misclassifications and resolving classification issues, you can ensure compliance with regulations and avoid any potential legal or financial issues.

Compliance and Documentation

When it comes to PCB assembly, compliance and documentation are crucial aspects that you need to consider. You must adhere to certain record-keeping and reporting requirements to avoid any legal issues and ensure smooth operations.

Record Keeping

One of the essential things that you need to do is to maintain accurate records of PCB assembly. You must keep track of the materials used, the manufacturing process, and the final product. This information will help you in case of any legal issues or disputes. It is recommended that you keep these records for at least five years.

To make record-keeping easier, you can create a table that includes all the necessary details. You can include information such as the type of PCB assembly, the quantity produced, the materials used, and the manufacturing process. This table will help you keep track of everything and ensure that you comply with the record-keeping requirements.

Reporting Requirements

Apart from record-keeping, you must also comply with reporting requirements. You need to report the details of your PCB assembly to the relevant authorities to ensure that you are operating legally.

The reporting requirements vary from country to country, and you must be aware of the specific requirements in your region. For instance, in India, you need to use the Harmonized System of Nomenclature (HSN) code for PCB assembly. The HSN code is a six-digit code that helps in determining the exact tax rate applicable to each type of PCB assembly. You can find the HSN code for PCB assembly on the official website of the Indian government.

To ensure compliance with reporting requirements, you can create a checklist that includes all the necessary details that you need to report. This checklist will help you ensure that you are reporting everything correctly and avoid any legal issues.

In summary, compliance and documentation are crucial aspects that you need to consider when it comes to PCB assembly. You must adhere to certain record-keeping and reporting requirements to avoid any legal issues and ensure smooth operations. By keeping accurate records and complying with reporting requirements, you can ensure that you operate legally and avoid any penalties.

International Trade and HSN Codes

Global Harmonization System

The Harmonized System of Nomenclature (HSN) is a standardized system of names and numbers used to classify goods and services for international trade. It was developed by the World Customs Organization (WCO) and is used by more than 200 countries. The system is based on a six-digit code, which is used to identify the product and its attributes.

The first two digits of the code represent the chapter, which identifies the general category of the product. The next two digits represent the heading, which identifies the product within the chapter. The last two digits represent the subheading, which identifies the specific product within the heading.

Export and Import Regulations

HSN codes are used by customs officials to determine the import and export regulations for a product. Each country has its own set of regulations and tariffs, which are based on the HSN code. It is important to accurately classify the product to ensure compliance with tax laws and regulations.

For PCB assembly, the HSN code is 8534.00.00, which falls under the category of electrical machinery and equipment and parts thereof. Import codes must be more specific regarding the PCB’s attributes like layer count, assembly status, and components. This allows customs to assess duties and taxes more precisely. Exports can use more general HS codes.

In conclusion, understanding HSN codes is crucial for international trade. Accurately classifying the product can help avoid delays and penalties at customs. It is important to stay up-to-date with the regulations and tariffs of each country to ensure compliance and smooth trade.